Translating the rise in customer numbers into higher revenue can come with a delay, Mr. Butterfield said the acceleration was driven by an increase in remote working. Total paying customers increased 30% to more than 130,000, and Mr. Slack said it now has 87 customers committed to spending more than $1 million over a 12-month period on its services, up 78% from a year-earlier. It had a net loss of $74.8 million, compared with $359.6 million in the same quarter a year ago. Slack on Tuesday said it had sales of $215.9 million, up 49% from the year-ago period, beating Wall Street expectations of $209.1 million, according to FactSet. Microsoft and Slack have been sparring verbally for over a year, since before the startup instant-messaging-software company went public in 2019.

Microsoft has said that it is committed to providing its customers a variety of choice and that it looks forward to providing additional information to the European Commission. In July, Slack filed an antitrust complaint against Microsoft in the European Union, accusing the software giant of abusing its dominance.

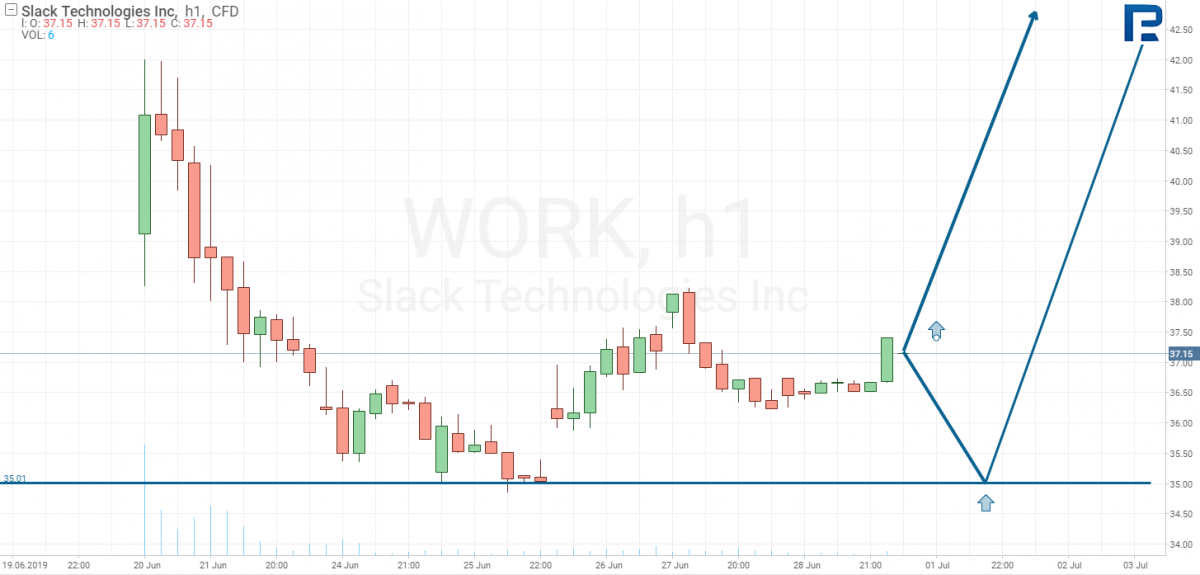

has been aggressively pushing Teams, its workplace-collaboration tool that competes with both Zoom and Slack. Zoom’s stock has risen more than fivefold.Īs businesses broadly are rushing to embrace the kind of digital tools that allow them to work remotely, competition among the vendors providing that software, already fierce before Covid-19, has intensified. Slack’s stock was up more than 30% this year before it posted its latest results. San Francisco-based Slack has enjoyed increased popularity from the pandemic, though not to the extent as some of its rivals. View Full Image Slack's quarterly revenue and net loss

0 kommentar(er)

0 kommentar(er)